Financial literacy is more than just knowing how to balance a checkbook or save money—it’s about understanding how money works, how to make informed decisions, and how to build a secure financial future. In today’s fast-paced world, where credit is easily available and spending is often encouraged, financial literacy has become a critical life skill. But what exactly does it mean, and why is it so important?

Let’s explore what financial literacy really involves and how improving yours can positively impact every area of your life.

Defining Financial Literacy

Financial literacy is the ability to understand and use various financial skills, including:

- Budgeting

- Saving

- Investing

- Borrowing

- Managing debt

- Understanding credit

It also includes the knowledge and confidence to make informed and effective decisions with all of your financial resources.

Being financially literate means you can manage your income, plan for the future, avoid unnecessary debt, and make wise investments.

Why Financial Literacy Is So Important

1. Empowers You to Take Control

When you understand how money works, you can take control of your financial decisions rather than letting money control you. You’ll be better equipped to make decisions about where to live, how much to save, and when to invest.

2. Helps You Avoid Debt Traps

Many people fall into debt simply because they don’t understand how credit cards, interest rates, or loans work. Financial literacy can help you avoid predatory lending, high-interest debts, and unmanageable financial commitments.

3. Builds a Strong Foundation for the Future

Whether you’re planning to buy a home, start a family, or retire comfortably, having strong financial literacy skills ensures you can plan for and reach those life milestones.

4. Reduces Financial Stress

Money problems are a major source of anxiety for many people. When you know how to manage your finances, you gain confidence, reduce stress, and build peace of mind.

5. Teaches Long-Term Thinking

Financial literacy shifts your mindset from short-term gratification (like impulse spending) to long-term goals (like retirement, travel, or education). It helps you see the bigger picture.

Read more: 10 Common Money Mistakes and How to Avoid Them

Key Areas of Financial Literacy

To be truly financially literate, you should focus on these core areas:

Budgeting

Understanding how to plan and control your spending is the foundation of financial literacy. A budget helps you live within your means and prepare for future needs.

Saving

Whether it’s for emergencies, a vacation, or retirement, saving consistently is crucial. Financial literacy teaches you to prioritize savings and make it automatic.

Credit and Debt

Knowing how credit scores work, how interest accumulates, and how to pay off debt smartly helps you build credit without falling into debt traps.

Investing

Understanding the basics of stocks, bonds, and other investment vehicles empowers you to grow your wealth and protect your financial future.

Risk Management

This includes insurance, emergency funds, and other strategies to protect yourself from financial setbacks.

Financial Goal Setting

Setting and tracking financial goals gives your money purpose and direction. Financially literate people are proactive, not reactive.

Signs You Need to Improve Your Financial Literacy

- You often run out of money before payday

- You don’t know how much you owe in debt

- You don’t have an emergency fund

- You use credit cards to cover basic expenses

- You avoid checking your bank account or credit report

- You don’t understand how loans or interest rates work

If any of these sound familiar, don’t worry—you’re not alone, and you can start improving today.

How to Improve Your Financial Literacy

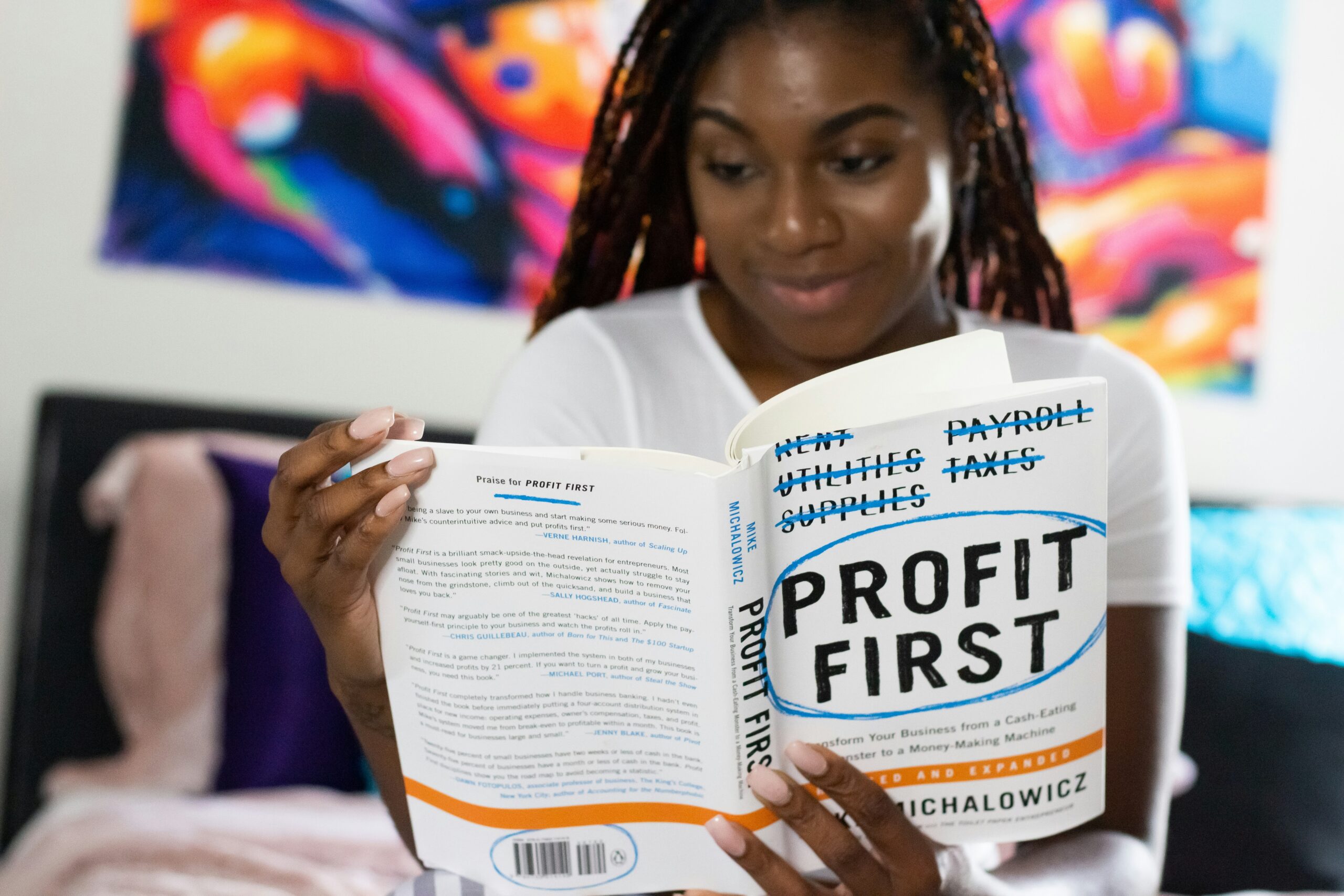

1. Read Books and Blogs

Look for beginner-friendly personal finance books or follow reliable finance blogs and YouTube channels.

2. Take Online Courses

There are free and paid courses on platforms like Coursera, Khan Academy, or Udemy that cover everything from budgeting to investing.

3. Use Budgeting Tools

Start tracking your spending with apps like Mint, YNAB, or Goodbudget. Seeing your finances in real-time helps reinforce what you learn.

4. Talk About Money

Break the taboo of talking about finances. Discussing money openly with trusted friends or family helps you learn and stay accountable.

5. Practice What You Learn

Start applying new knowledge right away. Make a budget, open a savings account, or check your credit report. Small actions lead to big results.

Final Thoughts: Knowledge Is Financial Power

Financial literacy isn’t something you achieve overnight—it’s a lifelong journey. But every step you take to understand and manage your finances brings you closer to freedom, security, and success.

In a world where money affects nearly every decision we make, being financially literate is one of the most empowering skills you can develop.

Start today. Learn something new. Apply it. And build the future you deserve.